Fast Canada Cash helps residents of Canada by providing them fast access to money. With car title loans, you can get instant cash on the same day as applying for the loan. It is quite easy to take a title loan. All you need is a vehicle such as a car, van, SUV, etc. which must be newer than the 2010 model. No credit check and no job required for the loan. We’re here to help you.

Get ready to convert your vehicle’s title into cash now with Fast Canada Cash. You can submit the lien-free title of your vehicle, collect the loan amount, and drive away with your vehicle.

Fast Canada Cash has licensed vendors that will loan money based on the value of your vehicle. Our licensed vendors have programs that provide you with quick access to cash based on the value of your paid off Car, Truck, Van, Suv, Rv or Boat, NOT your credit score! Your vehicle is your credit. Remember we loan you the money, and you get to keep your vehicle!

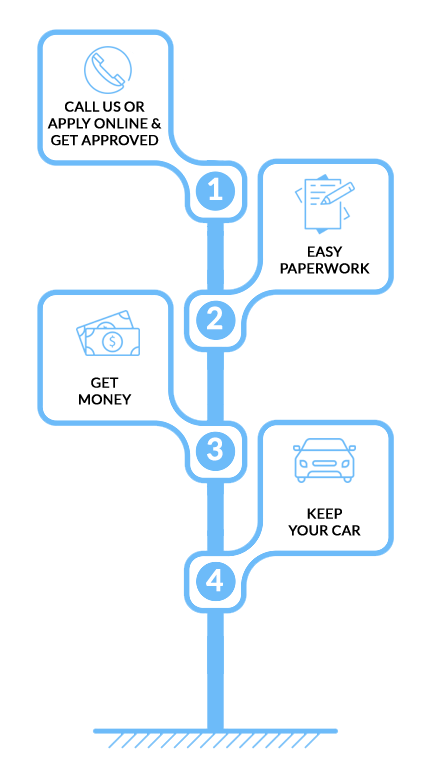

Step One – Call us or Apply Online & Get Approved

Fast Cash has continued to lend out money to people all over Western Canada since 2004. With one quick call or online application, you can get a quick cash loan. Once you have completed the online application, a representative will contact you shortly.

Step Two – Easy Paperwork

Documentation is supplied to us by you. Nothing hard. Simple things like a copy of your Driver’s License. The list is short and you can complete this part in under an hour.

Step Three – Get Money

When you arrive at our convenient location you will be greeted by a professional representative. They will be ready and waiting to assist you in finalizing the loan. The sales staff will take a look at your vehicle, explain your loan documents, and hand you your funds. It takes about 15 minutes and you are on your way. It is just that easy.

Step Four – Keep Your Car

Once all of the paperwork has been completed and you have the cash in hand, you are done. Just go back to your car, truck, van, SUV or RV and drive away, it’s that easy.

Need cash today? Call a ‘Cash Loans’ representative or apply online, today!

What else you need to know

Loan Fees:

The fees consist of an Auto Check (to check for accidents and vehicle origin), Lien Search (to make sure the vehicle is free and clear of all liens), and a Vehicle Inspection / Evaluation.

Implication of late payment or non payment:

In the event of a late or partial payment, interest fees will be charged on a daily basis on the outstanding amount. Failure to pay will result in legal action, as per Personal Property Securities Act (PPSA) of the respected province of Canada.

What Else You Will Enjoy With Our Collateral Loan?

In addition to getting quick cash on the same day of getting approved, there are several other benefits you’ll surely enjoy. Have a look at some of the major advantages:

- You’ll get the title loan at highly competitive interest rates.

- You can close the loan early and you’ll not be charged with prepayment penalties.

- You’ll get up to 4 years to pay back the loan amount.

Apply for car title loans now and get rid of any financial problems you’re facing.